- 06 April 2021

- Announcements

- 24 Comments

UCT Sale Summary

The public token sale has ended and we would like to start by thanking each and every contributor for their support. In this article we provide you with the key data of the token and the sale.

Token Metrics

- Name = UnitedCrowd Token

- Symbol = UCT

- Typ = ERC-20

- Listing Price = 0.02€ / UCT

- Listing Date = 15. April / 14 UHR CEST

- Initial Supply = 19,327,354 UCT

- Total Supply = 585.670.354 UCT

- Fully Diluted Market Cap = 11,713,407 €

- Trading Pair = UCT / ETH

- CEX Listing = LATOKEN

- DEX Listing = Uniswap

Find useful links (CMC, Coingecko..) regarding UCThere.

Token Values

With our UnitedCrowd Token (UCT) we aim to build a strong community. Therefore, the UCT offers the following usage rights and advantages:

- By owning UCT, token holders automatically become members of our UnitedCrowd community.

- As such, they are entitled to participate in delegated governance and benefit according to the decisions made by the community.

- Token holders can receive social rewards if they support the token and the community through activities.

- In addition, token holders have a higher probability of receiving pre-emptive rights in lotteries and benefiting from exclusive projects.

- In addition, UnitedCrowd implements a Token Repurchase Program. As part of program, UCT will be bought back by UnitedCrowd in the market and held by the company in the collateral pool.

- The UCT includes deflationary mechanism through toll bridge and token burning options.

- Token holders can participate in Liquidity mining and Staking and receive additional tokens.

We are continuously developing additional use cases to expand our community functions.

Token Distribution

- Token buyers who have purchased tokens via LATOKEN will receive their tokens directly from and via LATOKEN.

- Private Sale buyers, team, advisor and bounty hunter receive their tokens via their verified MetaMask Wallet, which has to be connected to the UnitedCrowd Platform

The prerequisite for receiving the tokens via MetaMask is a completed onboarding on the UnitedCrowd platform.

- Register on our platform: unitedcrowd.com

- Complete your KYC on the platform

- Connect your MetaMask wallet to the platform

In this article you´ll find a more details instruction

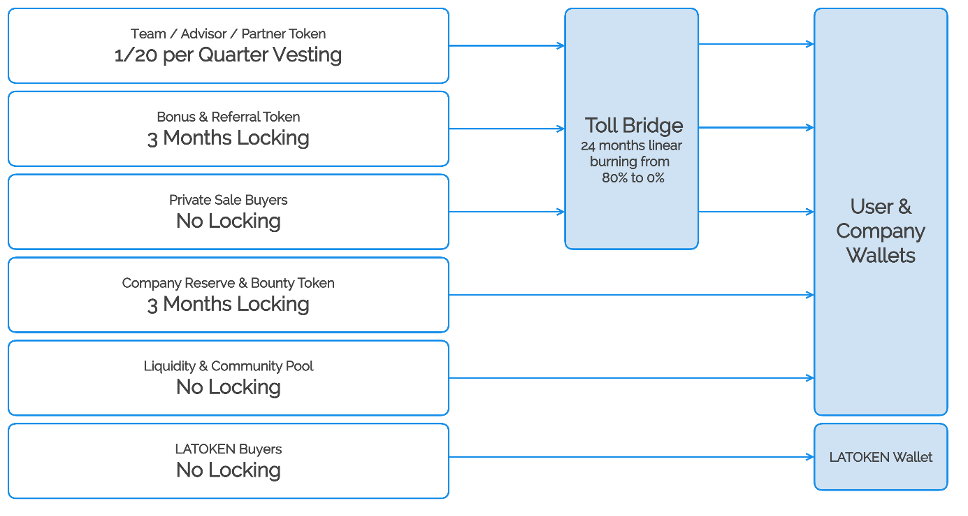

Vesting & locking

- Team, advisor and partner tokens are vested linearly at 1/20 per quarter.

- Bounty tokens, company reserve, bonus tokens and referral tokens are locked for three months.

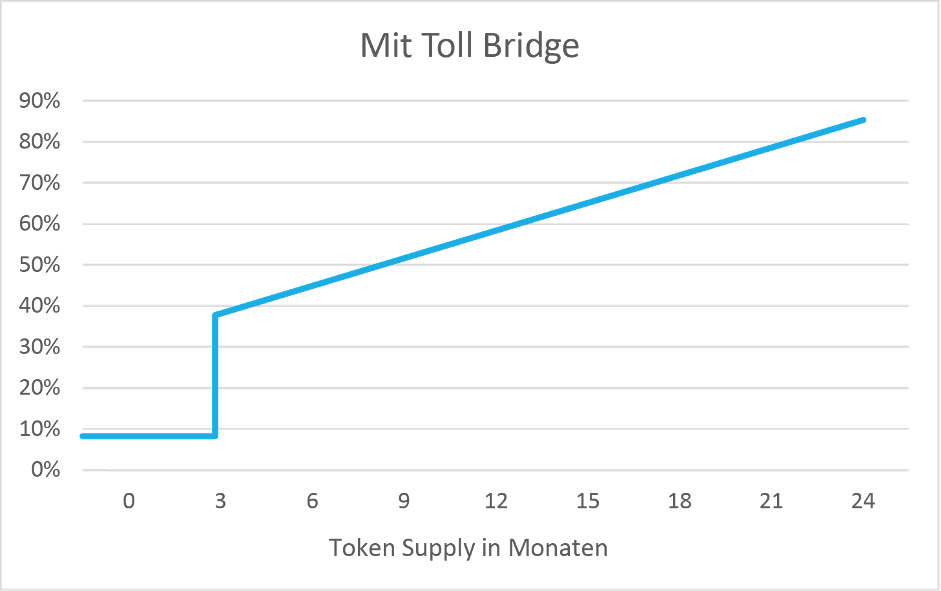

Token Supply

Strong holder mechanism

The crypto market and the technology it is based on are dynamic. We continuously monitor new mechanisms and evaluate them according to whether they offer meaningful added value for the project and the owners of our token. In recent months, various mechanisms have proven to be very effective instruments for positively influencing the trading value of a token, e.g. Toll Bridge, Liquidity Mining, Staking and Social Rewards.

- Toll Bridge

We have integrated a toll bridge mechanism that is designed to last for 24 months. Token holders who wish to exit before this period can do so for a fee. This fee, the toll fee, is a percentage fee, which is charged in UCT, deducted from the activated tokens and irrevocably destroyed by a smart contract.

The Toll Bridge applies to team, advisor, partner, private sale and bonus tokens. - Liquidity mining

At the decentralized exchange Uniswap, token owners can stake the trading pair ETH-UCT and receive LP tokens as rewards from Uniswap. The provision of the trading pair increases liquidity and has a positive effect on the token price.

The amount of the rewards corresponds to a share of the transaction fee that the Exchange charges from its users and is calculated on the total amount that has been deposited, i.e. staked. The LP tokens can also be staked on the UnitedCrowd platform (see “Staking”) and received from UnitedCrowd UCT. - Staking

Participants in Liquidity Mining (Liquidity Miner) can stake the LP tokens that they receive from Uniswap for the provision of the ETH-UCT pair on the UnitedCrowd platform and receive UCT as rewards from us.

You have to store the LP tokens for this on a personal MetaMask wallet that you have connected to your account on the UnitedCrowd platform. Participation in staking takes place as long as the LP tokens remain on the MetaMask wallet and as long as the trading pair is deposited at Uniswap. Both can be ended at any time at your own discretion.

Overall, Staking is rewarded up to a certain total volume (= Staking Pool). The staking pool does not apply to the individual token owner, but to the entirety of all staking participants. The shares in the staking pool are awarded according to the first come, first serve procedure. The stake amount per participant is not limited. The emptier the staking pool is at the moment a participant provides their LP tokens, the higher the percentage with which his/her rewards are calculated in the form of UCT. Initially, up to 80% p.a. will be awarded. The earlier, or in front of others, someone stakes their LP tokens on our platform, the higher the percentage remuneration they receive in UCT.. - Social Rewards Tasks that create added value for the community and the token are published in the Social Rewards system. Community members can edit them, upload and describe their work. Other members validate this work against certain incentives designed to achieve the best possible outcome for the community. Everyone who actively participated in a task – the processor and the evaluator – will be rewarded for their participation with stakes, reputation and voting power. These aspects determine how many UCT a user can collect and pay out as rewards. The activity of a participant is reflected in their activity score. He gains reputation through qualitative contributions. The more active a participant is, the more value he creates for the community and thus the token, the more voting power he receives. Social rewards lead to more reach, to new users and thus to more liquidity and help to retain users through incentives. Find out more about our Strong Holders Mechnism in this article.

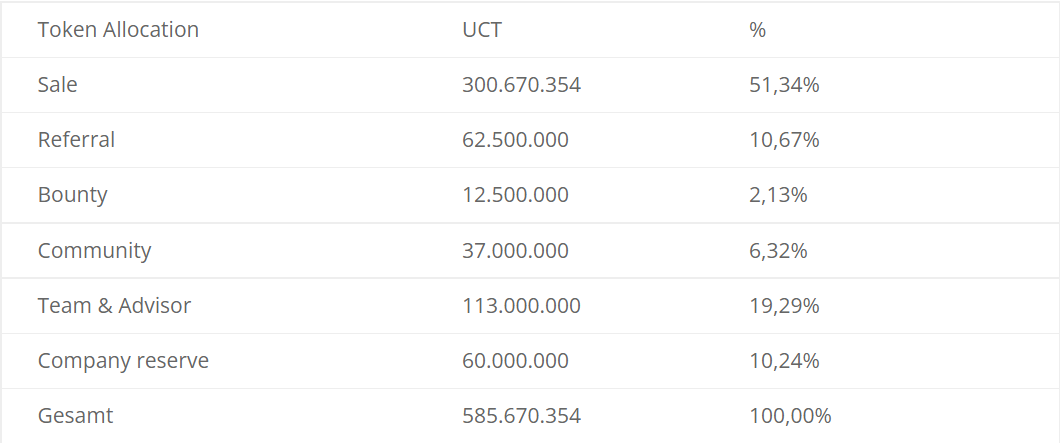

Token Allocation