- 06 April 2021

- Announcements

- 24 Comments

Going Mainnet: UnitedCrowd Tokenized VSOP

A VSOP (Virtual Share Option Plan) is a profit-sharing program which let team members participate in the increase of a company’s value. Profit sharing programs offer numerous advantages in general and a blockchain-based implementation is in particular able to overcome disadvantages of traditional programs.

Therefore, UnitedCrowd implements its own tokenized VSOP, which we will launch in early February. In this article you will learn how our program works and what advantages we offer to our team members.

UnitedCrowd VSOP: Tokenized profit sharing for our team

UnitedCrowd implements a tokenized profit sharing program to let current and future employees, freelancers, advisory board members and consultants participate in our economic success. With our Tokenized VSOP we give our team the chance to partake in the future increase in company value. Therefore, UnitedCrowd offers its team members the opportunity to receive virtual options that grant them a share in the proceeds in the event of an exit. The granting of virtual options has no influence on the calculation of possible bonus payments, pension plans or other remuneration. In contrast to a traditional “real” option program, the virtual options do not grant the right to take over company shares when they are exercised, but a contractual right to receive the payment of a certain amount of money. The assertion of this claim is possible in the event of an exit and is referred to as exercise. For this purpose, the partners provide part of their respective exit proceeds and profit distributions.

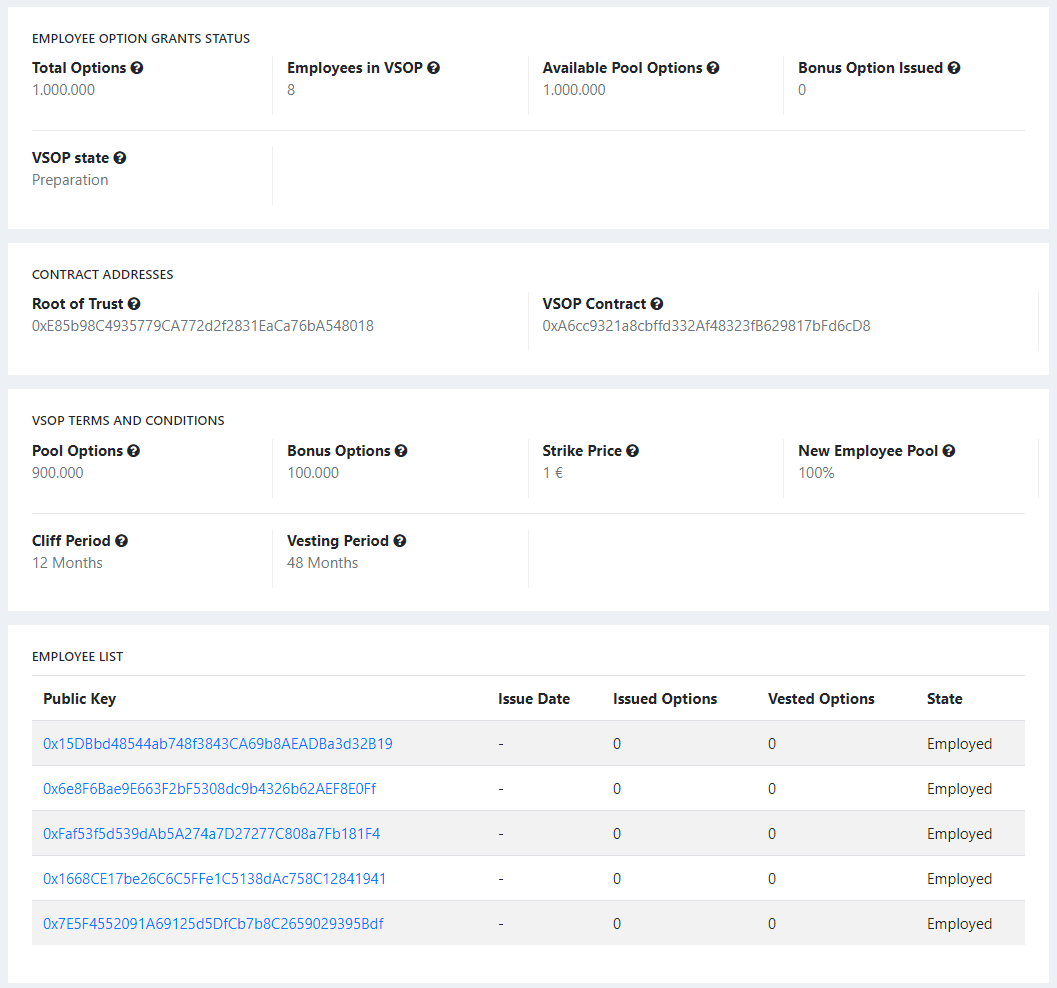

Offer and distribution of virtual options

UnitedCrowd can voluntarily offer its team members virtual options through a subscription form. This form is connected to the Ethereum network and allows the team member to accept the offer by signing our VSOP Smart Contract with his private key. A total number of virtual options – the pool – was set for distribution to our team. Every participating team member receives a certain percentage of this pool. Options that were distributed to team members are then removed from the pool. The number of options that a team member receives depends on how early his participation in the program begun, or rather how long he or she has been part of UnitedCrowd. That is because the more team members have already received options, the smaller the pool and the lower the total number of options from which the percentage of a new employee is calculated. Employees who have supported UnitedCrowd for a long time thus have more options than new team members.

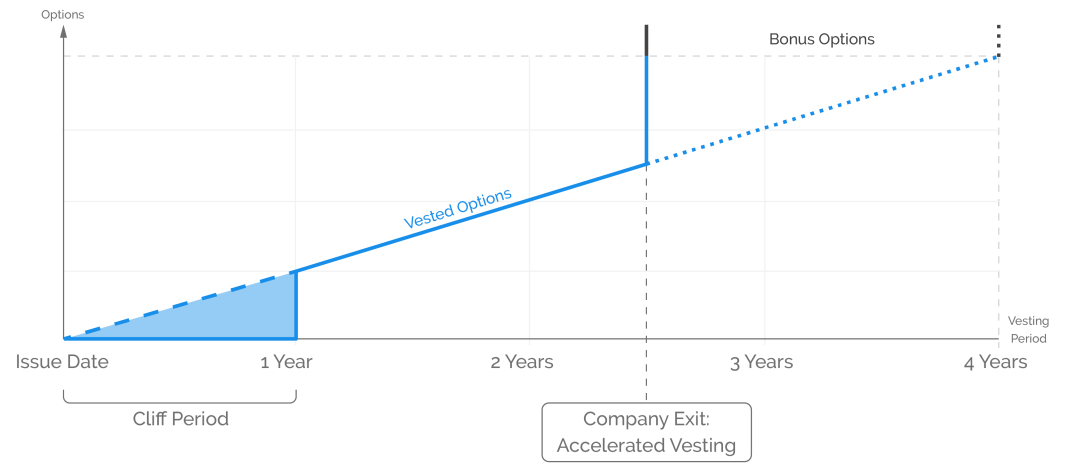

Vesting

The virtual options issued are subject to a vesting mechanism, i.e. an algorithm that determines how many of the options a person has been given can be exercised. Options that can be exercised are called “vested”. Immediately after options are issued to a team member, all options remain blocked for a certain period of time (cliff period). At the end of the cliff period, the proportion of exercisable options increases linearly monthly at the end of the last day of the month until all options can be exercised. If a team member leaves UnitedCrowd before their options are fully vested, they will retain the portion that is already exercisable at that time. The options that have not yet been vested are returned to the pool. However, this does not apply if the contract with the team member is terminated for reasons which he or she is responsible for, such as misconduct. Such an event is known as a “bad leaver event”. At a bad leaver event, all options that the team member owns expire and return to the pool.

Exit – the exercise event

Options grant their owners a right to receive the payment of a certain amount of money. This claim can be asserted in case of an exit, which is therefore also referred to as exercise event. An exercise event occurs when one of the following conditions is met:

- A sale and transfer of over 50% of the shares in the company in the context of one or more related transactions (“share deal exit”),

- Tokenization and transfer of over 50% of the shares in the company in the context of one or more related transactions through a token offer (“STO”) (“Share Deal Exit”),

- A sale and transfer of all material assets of the company in the context of one or more related transactions (“asset deal exit”)

- A stock exchange listing of the company (“IPO exit”) or

- An effective resolution of the general meeting to carry out a profit distribution / dividend higher than EUR 1,000,000 for a previous financial year.

There is no exercise event according to 1., 2. or 3. if it is an exchange, contribution or merger within the meaning of the “Umwandlungsgesetz” (Transformation Act) and the shareholders still hold more than 50% of the shares in the continuing company after this process.

Exercise notification and exercise period

If an exercise event occurs, we will inform our team members at least two weeks before the exit with an exercise notification. This notification includes an offer to the team member to sign an exercise smart contract with their private key (the exercise offer). The offer is made via an exit form that is linked to the Ethereum blockchain. The conditions for exercising are specified in the exit form. The team member can accept the offer within two weeks by signing it with their private key. His options will then be exercised on the terms set. If he does not accept the offer, UnitedCrowd has the right to exercise the options himself.

Payment after exercise

After exercising the virtual options issued in the course of our VSOP, the beneficiary has a payment claim against UnitedCrowd, which is calculated as follows:

Z = A x (E – B)

where applies

Z = (payment) entitlement to payment of the beneficiary;

A = (number of options) number of virtual options exercised by the beneficiary;

B = (base price) the base price per virtual option is EUR 1.

E = (Exiting proceeds or profit distribution proportion) the proportionate exiting proceeds or profit distribution proportion attributable to each virtual option

(i) corresponds to the issue price for an IPO exit;

(ii) is calculated for a share deal exit and an asset deal exit using the following formula:

E = ( e – k – p – b ) / (s + o)

where applies

e = (proceeds) The purchase price paid to the shareholders in the case of a share deal exit or in the case of an asset deal exit in the case of a fictitious exit of the company for distribution to the shareholders, taking into account any deposit amounts (escrows), purchase price retention and / or purchase price adjustments;

k = (costs) The costs borne by the partners for consultants and other transaction costs;

p = (preferences) The liquidation, proceeds and similar preferences to be paid in priority according to the relevant shareholders’ agreement or the articles of association;

b = (debt relief certificates) The payments to be made to certain persons on the basis of existing debt relief certificates or comparable contractual agreements in the event of an exercise event;

s = (share capital) The amount of the (sold) nominal capital of the company at the time of the exercise event;

o = (options) The number of virtual options saved and entitled to payment by all those entitled to options.

Note: The calculation of the exit proceeds or profit distribution share treats the option holders in the context of the exit transaction or profit distribution as if they had held / sold company shares themselves or as holders of company shares were to participate in the sales proceeds / profit distribution. In this respect, the nominal capital has to be increased by the number of virtual options entitled to pay (so-called fully diluted consideration) and the revenue preferences to be paid to certain shareholders as well as benefits based on debt recovery certificates.

Sale and inheritance of options

Options issued as part of our VSOP are not transferable without UnitedCrowd’s prior written consent. If options are transferred without prior approval, they expire without compensation. Inheritance options are possible.

Capital increase and capital decrease

The options issued are not subject to a dilution protection mechanism, for example in the event of a capital increase by the company. In the event of a capital reduction by pooling shares without repayment of capital, the number of options issued is reduced proportionately in accordance with the capital reduction.

Tokenized VSOP for your company

UnitedCrowd offers companies the opportunity to easily implement profit sharing programs with tokenized virtual shares. We will provide everything that companies need for VSOP on our platform – unbureaucratic, transparent and adaptable.