- 06 April 2021

- Announcements

- 24 Comments

Strong Holder Mechanism

Shortly before the end of the sale and thus shortly before the official listing of the UCT, we are at a crucial point: How will the token develop? The current bull market led to the introduction of new mechanisms in the crypto market. These mechanisms can help us to achieve the most important of all goals: To improve the performance of the UCT!

Success of the UCT is essential for all parties: for you as a token holder, but also for us as a company. As a tokenization provider, a rapid loss in the price of the token could lead to the worst image possible and can thus be a threat to our business model.

The essential factor for token performance is supply and demand. Therefore, incentives for buying, holding and promoting the UCT are extremely important. The more new owners and the more areas of application, the more liquidity – the better the token price!

STRONG HOLDER MECHANISM: A STRONG SIGNAL TO THE MARKET!

The crypto market and the technology is based on are dynamic. We continuously monitor new mechanisms and evaluate them according to whether they could offer meaningful added value for the project and the holders of our token. In recent months, various mechanisms have proven to be very effective instruments to positively influence the trading value of a token, e.g. Toll Bridge, Liquidity Mining, Staking and Social Rewards.

WE USE THE FOLLOWING FOR ALIGNMENT AS A UTILITY TOKEN:

In addition: As was negotiated with BaFin in 2019/2020, it is imperative to introduce rights of use to the UCT in order to be legally considered a utility token. This is what we do with the current steps. These rights offer significant added value for existing users and incentives for new users and are already integrated in the newly launched platform.

1. TOLL BRIDGE: FOR INITIAL LIQUIDITY SHORTFALLS

The Toll Bridge supplements the token vestings for “Strong Holders” and is set to last for 24 months. With the Toll Bridge, we are creating what we believe is a fair solution to distribute the initial selling pressure over time and to promote a positive price development for the benefit of the community of all token holders.

The Toll Bridge can best be understood as a “dynamic toll fee” for which a defined period of time, the toll period (24 months), is set. If a Strong Holder wants to sell token before this toll period has ended, he must pay a percentage fee for doing so. Thus, Toll Bridge prevents rapid sales, which would otherwise lead to a loss in price.

Strong Holders who want to get out before the end of the toll period can do so for a fee. This fee, the toll fee, is a percentage fee and is charged in UCT, which are then deducted from the activated tokens and irrevocably destroyed by a smart contract.

Hence, with the Toll Bridge, we are also introducing a deflationary mechanism that will reduce the number of tokens and give the market a strong signal for the medium and long-term price alignment of the UCT. The shortage of the circulating supply of tokens is an attractive argument for new token buyers at exchanges and thus support new liquidity. The mechanism is mapped completely live via the blockchain and also on the UnitedCrowd website, creating important transparency. Overall, the Toll Bridge promotes demand on the one hand and reduces selling pressure on the other – with correspondingly positive influences on the medium and long-term price development of the UCT.

STRONG HOLDER GROUPS:

LIQUIDITY MINING: PROVISION OF LIQUIDITY

Liquidity Mining refers to the process of providing tokens in a DeFi (Decentralized Finance) pool by token holders, for which they are rewarded with the issuance of another specifically created type of token. This type of token is known as an LP (Liquidity Provider) token. Token holders who participate in liquidity mining are called Liquidity Miners.

Liquidity Mining is required on decentralized exchanges (DEX) such as Uniswap, where – unlike traditional exchanges – there is no order book and therefore no matching. A DEX therefore has no way of determining market prices in these ways. Liquidity Mining means that independent persons, the liquidity miners, always provide a trading pair as liquidity at decentralized exchanges, e.g. ETH-UCT. Making available means that Liquidity Miners stake the tokens for a certain period of time and neither sell nor otherwise transfer them.

Liquidity Miners who put their tokens into the liquidity pool by staking receive so-called Liquidity Mining Rewards in return. The amount of these rewards corresponds to a share of the transaction fee that the Exchange charges its users and is calculated on the total amount of token that has been deposited, i.e. staked. As further rewards, Liquidity Miners receive LP tokens (ETH-UCT-LP) from the Uniswap Exchange, which can be staked as ownership vouchers and as proof of the provided liquidity on the UnitedCrowd platform and thus receive attractive rewards.

3. STAKING: RECEIVING REWARDS FOR PROVIDING LIQUIDITY

Liquidity Mining is important for the price development of the UCT. We therefor give UCT Liquidity Miners the opportunity to receive additional rewards in the form of UCT for making their liquidity available on Uniswap. For this purpose, we offer Staking on the UnitedCrowd platform.

Staking basically means that token holders deposit their tokens on a specific wallet and do not transfer them. For doing so, they receive additional tokens as rewards. In our case, the tokens stored must be UCT-ETH-LP tokens – exactly the tokens that Liquidity Miners receive for making liquidity available for trading with UCT at Uniswap. These LP tokens must be deposited by their owners on a personal Metamask wallet that is linked to the UnitedCrowd platform. For doing so, UCT are being paid out as rewards.

Overall, staking is rewarded up to a certain total volume. This total volume does not apply to the individual token owner, but to the entirety of all staking participants. This total volume is called staking pool.

The shares of the staking pool are awarded according to the first come, first serve procedure. The stake amount per participant is not limited. The emptier the staking pool is at the moment when a participant provides his LP token, the higher the percentage with which his rewards are calculated in the form of UCT. Initially, up to 80% p.a. will be awarded. The earlier, or earlier than others, someone stakes his LP tokens on our platform, the higher the percentage remuneration he receives in UCT.

Similar to an interest-bearing credit in a bank account, rewards are distributed for staking LP tokens. If the liquidity is withdrawn from Uniswap, further rewards do not apply.

The staking of LP tokens will start three months after the token listing.

4. SOCIAL REWARDS: WIDER REACH THROUGH ACTIVITIES

The Social Reward System is based on the idea of an activity program in which users who actively support the community and the project receive UCT.

Tasks that create added value for the community are published in the system. Community members can edit them, upload and describe their work. Other members then validate this work against specific incentives designed to achieve the best possible outcome for the community.

Social Rewards führen so zu mehr Reichweite, zu neuen Nutzer und somit zu mehr Liquidität und helfen bei der Bindung der Nutzer durch Incentives.

Everyone who actively participated in this task – the processor and the evaluator – will be rewarded for their participation with stakes, reputation and voting power. These aspects together determine how many UCT a user can collect and pay out as rewards.

The activity of a participant is reflected in his activity score. He gains reputation through qualitative contributions. The more active a participant is, the more value he creates for the community and thus the token, the more voting power he receives.

Social rewards lead to more reach, to new users and thus to more liquidity and help to retain users through incentives.

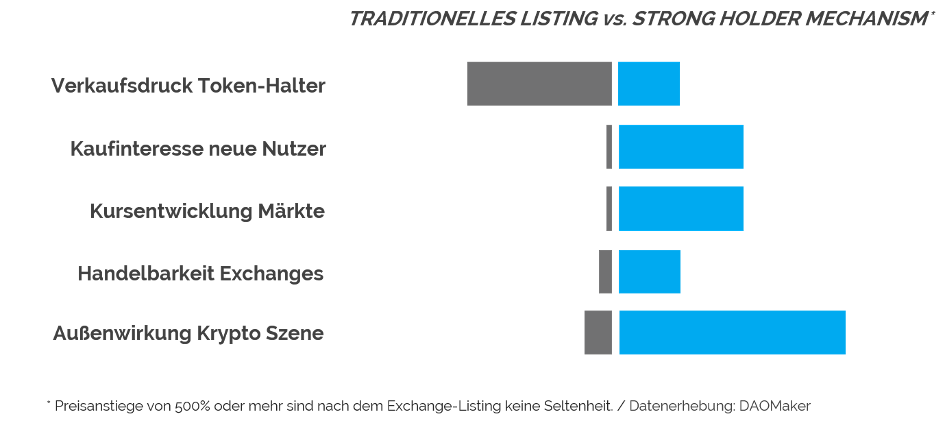

STRONG HOLDER MECHANISM: SIGNIFICANTLY BETTER PERFORMANCE

OFFER: OUR LIQUIDITY MINING BONUS FOR YOU

Make ETH available at Uniswap and we will double your liquidity with the same value in UCT if you make the liquidity available for at least one year, i.e. stake your ETH and the UCT you receive from us at Uniswap for one year. Of course, you can also take part our normal Liquidity Mining, which is not bound by time, and benefit from staking rewards without getting an extra bonus.

The following packages are available:

- Level 1: > 10 ETH (+ 100% bonus in UCT)

- Level 2: > 2 ETH (+ 100% bonus in UCT)

- Level 3: > 0.5 ETH (+ 100% bonus in UCT)

The levels define the order for staking and are booked according to the first come, first serve procedure.

Again: We’ll double your credit! All you have to do is leave ETH on your wallet for at least a year. You will receive a 100% bonus in UCT on the number of these ETHs.

Profit from:

- Doubling of liquidity through UnitedCrowd

- Interest on trading fees at Uniswap

- LP Token for staking at UnitedCrowd

- Staking distributions on LP tokens of up to 80% p.a. in UCT

- Reputation enhancement: preference for future offers

- Governance rights

We are at your disposal if you have any questions or are unsure how to technically participate in staking. While it may sound complex, the process is actually surprisingly simple!