- 06 April 2021

- Announcements

- 24 Comments

Cryptocurrency: What is the difference between a Coin and a Token?

Those new to the world of cryptocurrency often hear the terms ‘coins’ and ‘tokens’ and assume the two to be interchangeable. However, this isn’t the case. Coins refer to the actual currency itself, whereas crypto tokens refer to something that a much more sweeping usage. Below, you’ll find a more thorough breakdown of the differences.

Cryptocurrency coins explained

Cryptocurrency, often simply referred to as coins, operates on its respective blockchain. While many coins are forks that have been spun off form the likes of Bitcoin, others have been created and developed independently. As such, they have unique differences and operate with distinct differences when it comes process, record-keeping and transactions. Some coins are a lot quicker than Bitcoin, with one such example being Stellar. Generally speaking, coins utilise Proof-of-Work or Proof-of-Stake in an afford to keep respective networks a secure environment.

One specific type of action a cryptocurrency coin offers is the concealment of transactions. The problem faced by users is that transactions are generally actioned over a blockchain that is public. Some coins, such as Monero, help conceal the transaction by deploying numerous fake transactions, making it difficult for a third-party to follow the true course of money over a genuine transaction. Other cryptocurrency coins, like Zcash, overcome the obstacle by providing evidence of a transaction, without allowing visibility of the transaction.

Crypto tokens explained

Unlike cryptocurrency coins, tokens don’t have a blockchain of their own. Instead, crypto tokens operate on a platform that instead has its own blockchain, as well as a native cryptocurrency coin. With tokens, users have a recognisable asset that can be traded. Platforms like Ripple, Ethereum and others are major examples of this type of platform. Tokens are most commonly used for raising funds as part of an Initial Coin Offering (ICO). As soon as the target funds have been realised, the crypto token in question will be moved to its own blockchain, maturing into a bona fide cryptocurrency coin.

Let’s look at a specific example in more detail. Take a decentralised platform Ethereum. This platform has its own own native crypto coin called Ether (ETH). In most cases, tokens that operate on this network are known as ERC20 tokens. EOS and Tronix are currently the chief ERC20 tokens. Both tokens are looking forward to their own mainnet launches, an important technical part of any blockchain project. Once realised, these Ethereum network tokens will transform into coins in their own right, both running on their very own blockchain.

Coins vs. Tokens — key differences

In short, coins should be looked at as a digital alternative to cash. They are designed to be utilised for exchanging for the purchase of goods or services. They can also be traded between currency users. In the past, coins such as Bitcoin were looked upon as a way to store value and stockpile assets, as opposed to being utilised as a digital currency. There’s been controversy around it, with rises in fees sparking outrage with users, as well as those disagreements between those who use Bitcoin to profit and those who are more focused on it becoming a better alternative to conventional currency.

Unlike coins, tokens have a much wider range of applications. Additionally, there are several different types of tokens. Some of these include reward tokens, asset-backed tokens, not to mention utility tokens. Reward tokens are usually awarded to help establish the authority and reputation of an online entity. Asset-backed tokens are often associated with an actual asset (such as precious metals) in a similar way as to how conventional currencies once operated. Utility tokens are simple in their nature, being used to pay for DApp specific services.

Tokens — how do they work?

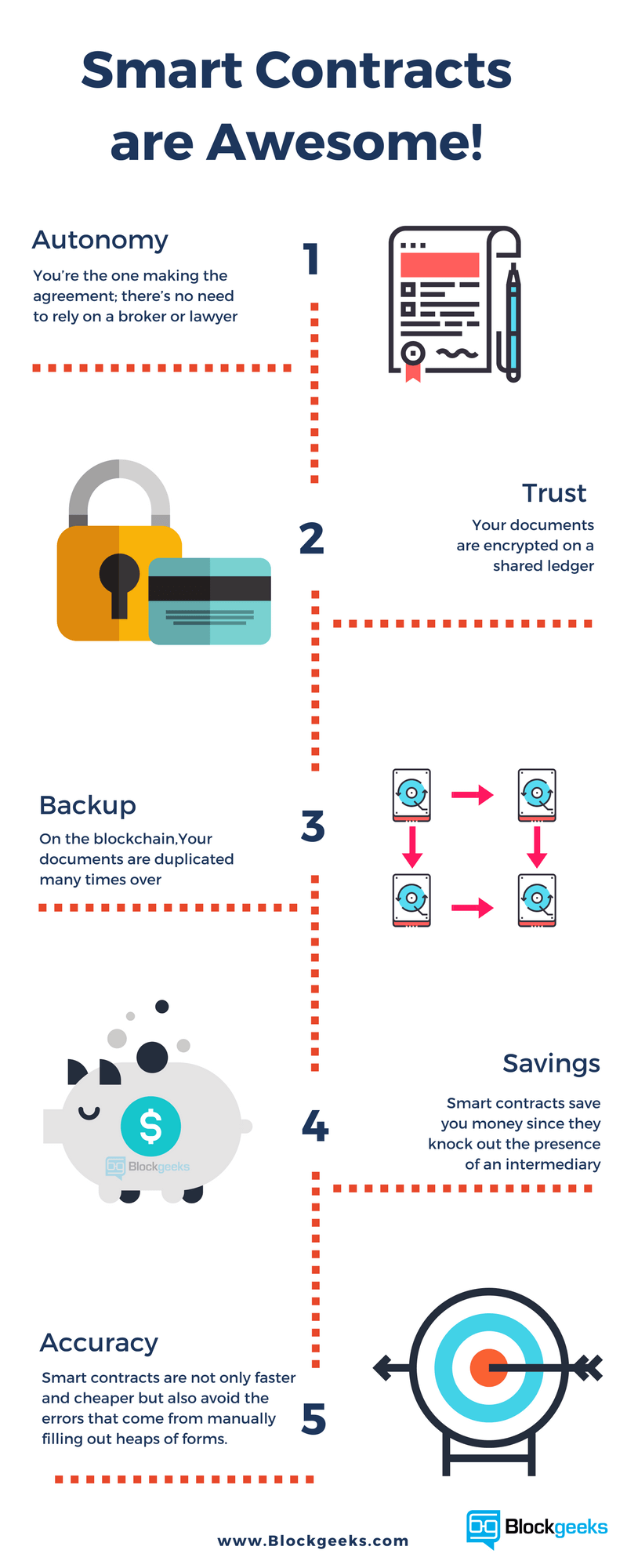

Tokens operate in a fairly straightforward manner via smart contracts. These smart contracts can be better understood as executing scripts that run automatically, operating over decentralised networks. The result here is that there’s no downtime to worry about, as well as no need for a trusted party to be in place to oversee smart contracts are executed. In some instances, cryptocurrencies utilise smart contracts when it comes to connecting external data to blockchains. This is so execution is guaranteed and that data can be gathered without third-party involvement.

© Courtesy of Blockgeeks.com

The roles of decentralised applications (DApps)

Decentralised applications are a pivotal part of the system and have a wide array of applications. There is one key drawback and limitation of them, however. This is network latency. In short, network latency refers to the overall network speed. While the likes of Bitcoin blocks are relatively slow, taking around 10 minutes to be created, others like EOS boast block times of approximately 500 milliseconds. This highlights the huge discrepancy that exists.

If you’re having trouble picturing decentralised applications, try imaging the network itself as a flat foundation. Then, imagine DApps as building blocks laid atop this foundation. These blocks need to be designed in a compatible way in order to be laid and built higher, but the blocks themselves can be one of many shapes and sizes. Crypto tokens then enable these applications to run, while also providing a monetary currency that finances everything. They can also operate on blockchains that aren’t actual platforms, much like Bitcoin, but they do suffer from significant limitations.

In conclusion

It’s clear that the vocabulary used in the crypto realm needs rethinking and updating. Currency is too specific a word to accurately describe the wide array of projects and activities currently being created and continuing on within the crypto environment today. The likes of Bitcoin might have set the trend and paved the way for successors, but without looking forward and allowing for innovation, the future is limited. Crypto tokens are a prime example of innovation, while the ongoing competition between different types of coins is ensuring improvements in speed and security across the board.