- 06 April 2021

- Announcements

- 24 Comments

Security-Token: Tokenized Securities vs. Securitized Token

Security tokens, digital securities, blockchain-based financial products – whoever deals with digital investments will sooner or later hear many different buzzwords. They are rarely clearly defined – on the contrary: the use of different terms to describe identical forms of digital investments and an unclear demarcation between different variants seem to contribute to a general confusion regarding digital investment. Thus, today we would like to clarify and present the most important variants from the area of digitized financial products.

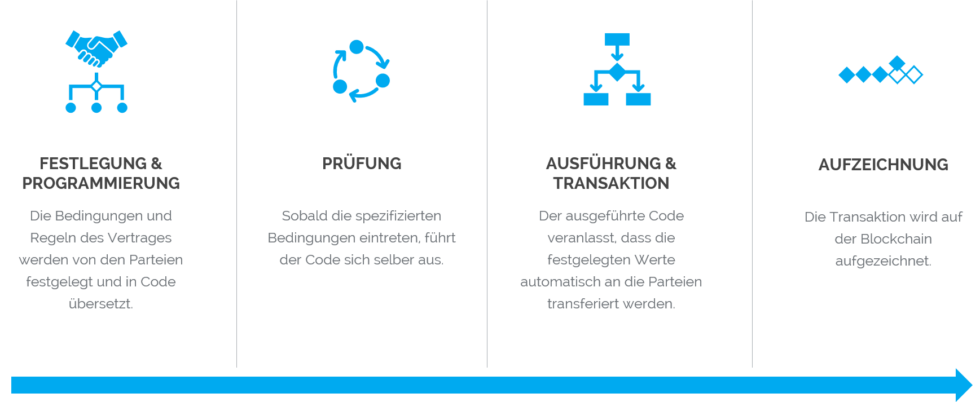

Let’s start with the basics: tokens. Tokens are information units on a blockchain that can be assigned to an owner and can be transferred between blockchain users. They are based on smart contracts, so-called self-executing contracts. Technically speaking, smart contracts are protocols that digitally represent a contractual regulation. These digital contracts are self-executing insofar as they can automatically trigger another event when a defined event occurs. For example, if a contractually agreed period of two years has expired (event A), then a payment to the token holder can be triggered automatically (event B). The smart contract of a token can be designed individually and defines the rights that the owner of this token receives. In this way, everything that can be contractually mapped and thus every value can be digitized in the form of a token. This process, i.e. the digital representation of a value including all rights and obligations contained in this value in a token, is referred to as tokenization.

Almost anything can be tokenized. The spectrum ranges from loans to shares, usage rights, vouchers to real estate, precious metals or insurance. Since in all of these cases, ownership, transfer or use is always based on a contract, this contract can be transferred to a smart contract who is defining a token. Depending on what is tokenized, different types of tokens result. The differentiation of these types is based on the rights that a token grants to its owner and is relevant for the legal classification of the token. The most important types are called utility tokens and security tokens.

Utility-Token

Utility tokens grant usage rights to their owner. They entitle the holder of a token to use a certain service or to use a certain product. For example, the smart contract of a utility token can be designed so that the holder of this token can access an online platform or exchange the token in an online game for certain game gadgets. If utility tokens are issued and sold by a company, a community can hereby form – the community of token owners who have the right to use the company’s product, for example. From a legal perspective, it is important that utility tokens do not provide a monetary incentive to own the token. For example, neither dividends nor the token price must be paid or refunded to the token holders. Also, utility tokens do not represent ownership rights. They are therefore neither a security in the sense of the WpPG, nor an investment in the sense of the VermAnlG.

Security-Token

Security tokens can digitally represent different asset classes and thus have a value just as a tangible asset, for example similar to shares in a company or a property. Before we take a closer look at security tokens, we would like to introduce an important distinction: tokenized securities and securitized token. What sounds like a play on words is in fact an essential differentiation within the class of security tokens, which is particularly important for the future development of the market for digital financial products.

Tokenized securities

Tokenized securities are established financial instruments that are digitally represented in a token by tokenization. The underlying smart contract grants the owner of the token rights to a value and corresponds exactly to the contract that is used for the respective financial instruments. The range of financial instruments that can be digitized in the form of tokenized securities includes equity, debt and asset products. Accordingly, one speaks of equity, debt and asset tokens.

Equity-Token

Equity tokens are tokenized securities and represent participation rights. Thus, they represent rights to participations and can also be given voting rights. Equity tokens are therefore a digital equivalent to stocks or futures. They grant the holder of the token the same rights as owning a classic share – but they are transferable on the blockchain and offer further advantages, which we will discuss later. Companies can issue equity tokens for financing, for example – according to the same principle as selling shares in an IPO.

Debt-Token

Debt tokens represent claims. The owner of a debt token therefore holds a debt claim for repayment of the amount invested in the token purchase with or without interest. All conditions of this requirement are defined in the smart contract and can also be designed so that the repayment is made automatically, for example, in fixed monthly instalments. Debt tokens range from bonds to loans to bonds. For example, by issuing and selling debt tokens, a company can finance a planned project through debt in the form of subordinated loans. By purchasing and owning these tokens, token buyers then have the right for the company to repay the amount invested within a certain period plus interest.

Asset-Token

Asset tokens are the third of the types of tokenized securities. They give their owner property rights to liquid or illiquid assets. To a certain extent, the token represents the title deed, for example in cash, real estate or also intangible assets such as patents or trademark rights. An asset token can be designed in such a way that it represents ownership of any large or small proportion of the total value. For example, ownership of a property could be represented by a thousand asset tokens, with each individual token representing ownership of a thousandth. One then speaks of so-called fractional ownership.

As you see, tokenized securities are existing financial products that are digitally represented in the form of tokens on the blockchain. They offer their owners the same rights and obligations as their non-blockchain equivalents. But what are the advantages of digitization, i.e. tokenization? As a token, these financial products can be transferred directly between blockchain users at any time and without intermediate instances – and at low cost. In contrast to physical contracts, no notaries or banks are required for this. As a digital product, the investment process is also purely digital and can therefore be way faster than on traditional products. Clearing and settlement always take place at the same time, which is why there is no counter pay risk. The transparency of the blockchain also makes it possible to display any cash flows. Furthermore, companies can address an international market by issuing tokens, because tokens can be bought internationally via the blockchain. The fact that smart contracts can be programmed to perform certain functions automatically can also be used to reduce long-term workload. The already mentioned possibility of selling assets in the form of fractional ownership asset tokens not to one, but to many investors, offers both sellers and buyers new opportunities. In this way, buyers can invest with smaller minimum investments in areas that previously required large sums, such as real estate. Sellers have the opportunity to achieve an overall higher sales price. With a view to the future, the possible tradability of tokens is certainly one of the plus points on the side of tokenized securities.

Securitized token

The potential of blockchain technology and tokens is far from exhausted with utility tokens on the one hand and tokenized securities on the other. Why choose usage rights or financial products when the technical possibilities allow

both? If it is possible to combine the advantages of both types of tokens and thus create a completely new asset class? At this point we take a look at the latest development – on securitized tokens. Securitized tokens are

financial products that comply with the regulations, but which also grant their owner rights of use. In a way, they are a hybrid of tokenized securities and utility tokens. Based on established financial products, such as subordinated

loans or participation rights, depending on the individual case, additional rights can be included in the tokens that grant the owner access to products.

This idea becomes less abstract if we illustrate it with an example:

A company wants to expand its portfolio with a new product line and requires capital for this. Let’s assume the company sells a fitness app so far and now wants to offer a nutrition app. For Mobile Development and launch, it

now needs capital and would like to borrow it with a loan that it will later pay back with interest. It is of course in the company’s interest to pay the lowest possible interest. At the same time, it is good for its then new

nutritional app to reach as many users as possible right from the start. The company now has the opportunity to design a securitized token that can meet these needs while also satisfying investors. The token is designed in

such a way that it represents a compliant subordinated loan. The token buyer receives the invested amount after a certain time, e.g. within two years including interest. At the same time, the token owner also receives usage

rights for the app. With the token he can use the app free of charge and has e.g. also access to special recipe functions. Because he has these access rights, he receives less interest than might otherwise be usual on the market

for other subordinated loans. He is still satisfied, because he deliberately chose this investment because he believes in the app and finds it exciting and useful. Both parties have a benefit, the company receives capital at

low interest rates and can build a community of app users. Investors receive interest and can use a product they are convinced of. It’s easy to see that securitized tokens enable completely new forms of corporate finance.

Utility Token, Tokenized Securities and Securitized Token – UnitedCrowd is a partner for digital corporate finance. We would be happy to advise you on which concept best suits your company’s requirements.